Program Overview

GENERAL DESCRIPTION

PVB’s Amazing Race is the sixth run of the internal deposit campaign designed to incentivize PVB officers and staff who are able to bring in or refer new deposits. The campaign has the following main objectives:

- Build up private low-cost deposits and achieve a P1.5B target

- Reinforce a performance-based culture among Veteran Bankers

CARRY OVERS AND MODIFICATIONS FROM PREVIOUS CAMPAIGNS

In PVB’s Amazing Race, just like in previous campaigns, Head Office personnel are automatic participants to the Program to augment the production efforts of the branch people. Unlike previous deposit campaigns, PVB’s Amazing Race purely targets fresh, private, low-cost deposits. To provide opportunities for participants to win prizes, we will be employing the following strategies: Award Points for the ADB of solicited accounts, a monthly raffle for those who bring in fresh accounts (new accounts and top-up on existing CASA), bonus rewards for monthly performers, Bonus Points for achieving milestones, and a Grand Travel incentive for overall top performers at the end of the Program.

AWARD POINTS

A participant’s production is translated to Award Points (AP). All Award Points can be redeemed for travel and electronic gift certificate rewards featured on the PVB Amazing Race Website and/or catalogue. There will still be points that can be earned individually and points that can be earned through team effort.

To earn Award Points, a referred deposit account must generate an ADB of at least P1,000 or US$ 25 in a month. The generation of Award Points is as follows:

| Employee Category | For every P1000 INDIVIDUAL ADB | For every $25 INDIVIDUAL ADB |

|---|---|---|

| Sales Officer / Staff | 2 Award Point | 2 Award Point |

| Non-Sales Officer / Staff | 4 Award Points | 4 Award Points |

| Employee Category | For every P1000 CORPORATE ADB | For every $25 CORPORATE ADB |

|---|---|---|

| Sales Officer / Staff | 1 Award Point | 1 Award Point |

| Non-Sales Officer / Staff | 2 Award Points | 2 Award Points |

Additionally, Individual Deposit Accounts earn 2x Award Points over Corporate Accounts.

-

DEPOSIT HURDLE – As an added hurdle, before any participant can earn Award Point, he/she must first generate or refer P5,000 single or accumulated fresh/new deposit. This hurdle or threshold will not be counted in the computation of a referred account’s ADB and thereby will not be eligible for the computation of Award Points.

Existing deposits may be included in the program as long as the Deposit Hurdle is first met and that the existing deposit will be topped-up with at least P1,000 or $25 in order to meet the ADB requirement for earning Award Points. Prior to the program launch, an ADB base line will be determined which will be the benchmark for computation of incremental ADBs.

At the end of the program, the top performing officer and staff of each league will win an all-expense paid vacation trip to an Asian country. The Travel Award has also been restructured to give other top performers a chance to win the travel award in case a particular travel slot is not won. This means that there are 22 guaranteed slots for the Grand Travel Award.

PVB’s AMAZING RACE hopes to once again rally the employees to replicate their past successes in previous campaigns. The primary objective is to raise P1.5 Billion in fresh private deposits by the end of the 12-month campaign period. This target amount is on top of the management-sanctioned deposit target for 2019 and 2020.

PROGRAM RULES AND MECHANICS

Inclusive Dates

The program will run effectively from July 1, 2019 to June 30, 2020.

Eligibility

The program is open to all regular and probationary PVB employees who are not facing or serving disciplinary/administrative cases or sanctions. All directors and senior officers of the Bank are also eligible for the program.

Additionally, contractual employees and project hires are also eligible to join the program provided that their employment/contract with PVB is within the program period.

In case of resignations, retirements, non-regularization or end-of-contracts, only points earned up to the month of employment with PVB will be credited and will be redeemable by the participant.

Leagues

To spur friendly competition amongst VeteranBankers, all qualified participants will be assigned into Leagues.

- League I – Head Office 1 (Offices Under the Office of the Chairman)

- League II – Head Office 2 (Offices Under the Office of the President)

- League III – BBG Head Office (all Head-Office Based BBG offices)

- League IV – Intervest and NAGON

- League V – Metro Manila North Branches

- League VI – Metro Manila South Branches

- League VII – North Luzon Branches

- League VIII – Central Luzon Branches

- League IX – South Luzon Branches

- League X – Visayas Branches

- League XI – Mindanao Branches

Handicapping

PVB’s Amazing Race will feature a new handicapping scheme different from previous deposit campaigns. All employees will now be categorized into either Sales or a Non-Sales. A Sales Officer/Employee is defined as a PVB employee whose primary function or responsibility is to bring in clients to the Bank.

Under this new handicapping scheme, the following points will be awarded:

| Employee Category | Points Handicap |

|---|---|

| Sales Officer or Staff | x1 |

| Non-Sales Officer or Staff | x2 |

Products Eligible for Award Points

Only the following products are eligible to earn Award Points for participants:

- Peso Savings Account / ATM Account

- Peso Checking Account

- Dollar Savings Account

The following accounts are not eligible to earn Award Points:

- Existing accounts closed and then reopened

- Accounts transferred from one branch to another

- Accounts opened/required to secure a loan or other obligations

- All government accounts

- Accounts with special rates

- Garnished, frozen or sequestered accounts

- Accounts of affiliates

- All forms of Trust, Pension & SSS accounts

- All forms of Time Deposits and Special Savings

The Bank, may, however include new products in the program. Although government accounts are NOT included in the incentive campaign, all employees are still encouraged to continue the solicitation and servicing of government accounts.

Monthly Raffle

Every month during the program duration, participants will earn one raffle entry for every P1,000 and $25 in account opening of their referred accounts. This will qualify the participant only for the monthly draw of the month when the account was opened.

Every month, 3 winners will be drawn via an electronic raffle system and each winner will receive P3,000 worth of eGCs.

Participants will also earn raffle entries for top-ups of at least P1,000 or $25 made by referred existing accounts. However, only one raffle entry will be earned by existing accounts for the duration of the program even if additional deposits are made throughout the program period. The raffle entry will only be earned on the month that the first top-up was made.

Should it be possible to hold a grand raffle (depending on the program’s performance), all non-winning entries from previous months automatically qualify for the grand draw.

Top Monthly Performers

The top three (3) individual performers per month will also be awarded prizes. A top performer of the month will be defined as an individual participant to the program who is able to generate/refer the biggest deposit amount for the month.

The top three individuals with the most deposits for the month will each receive P5,000 worth of eGCs.

Award Points

There are two types of Award Points – Regular Award Points and Bonus Award Points.

Both regular and bonus Award Points have equal value for redeeming rewards. However, only the regular Award Points will be used in computing the individual, team and league achievement awards. Additionally, only regular Award Points will be computed in determining winners of the Grand Travel Reward.

-

Regular Award Points are earned from:

- ADB of these new accounts opened by new and existing customers beginning July 1, 2019 for as long as they are fresh funds.

- Award Points for walk-in clients will be credited to the Branch Pool.

- Statements for the Branch Pool will be released every three periods. Pool Award Points can be redeemed only after the release of the statements.

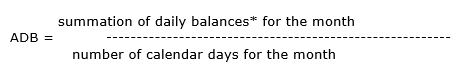

The branch may either divide the Award Points among the members or may redeem items from the branch pool for distribution to the members. - ADB Award Points will be computed based on the following formula:

- Interest on the deposit which is already credited to the account shall be included in the computation of ADB for Award Points.

- Bonus Award Points are awarded to the individual participant for the completion of certain critical activities, for special achievements, and for active participation in the team. These “milestones” will be announced beforehand to all participants via email and other available channels.

Employee Movements

- New employees will be assigned to teams based on their department or branch assignment.

- Transferred employees may be reassigned to a team at their new location. For purposes of team competition, Award Points earned after the date of transfer will be credited to the new team.

- Resigned employees may redeem all award credits they have earned as of the month of resignation.

- Contractuals or project hires who become regular employees of the Bank during the program period will not experience any disruption in their points earning or redemption. However, Area Head/Department Head should furnish the Program Committee with copy of the memorandum regarding the change in the participant’s employment status with the bank

- Terminated employees, employees with pending administrative cases punishable by dismissal, employees under preventive suspension and those who resign without giving the required notice forfeit all Award Points.

- Should there be a change in the status of an employee from one category to another during the duration of the program, the Area Head/Department Head should furnish the Program Committee with a copy of the memorandum regarding the change in the concerned employee’s assignment. Following its date of effectivity, the new award credit schedule will be implemented on the succeeding month.

MECHANICS FOR EARNING AWARDS CREDITS

As in previous campaigns, Introduction Cards or Intro-Cards will be used during the campaign to track referrals and award the corresponding Award Points to the individual participant.Each participant will receive a set of Intro-Cards which they must immediately sign and fill out with their Referrer’s Info including Full Name, Branch or Department, and Company ID.

The participant must give his prospect or referral an Intro-Card with referrer’s info. The Intro-Card will serve as proof that he is the one who referred the client to open a new account; he must provide a separate Intro-Card for every account that the prospect/referral will open. Additionally, the prospect/referral must write his/her name and sign-off on Intro-Card on the tear-off portion. This tear-off portion will be retained by the PVB employee.

A client opening several accounts may opt to give the award points to more than one employee by signing separate Intro-Cards for each account opened. For example, if Juan De la Cruz opens two accounts, a peso savings account and a dollar savings account, his peso savings may be credited to employee “A” and the dollar savings account may be credited to employee “B”.

When a prospect/referral opens an account, he must present the signed Intro-Card, along with the other documentary requirements and a data privacy waiver, to the servicing branch or business unit. All existing PVB internal controls in the solicitation, opening and servicing of accounts, and prescribed government and regulatory agencies restrictions such as those under the Anti-Money Laundering Act and the Data Privacy Act of 2012 shall still be observed and implemented during the campaign.

To verify the Intro-Cards of referring employees, the Intro-Card must be signed by the Customer Service Assistant (for new accounts) or the teller (for existing accounts) as the “Maker” and by the Branch Services Officer or Branch Operations Officer as the “Checker”. This process verifies that the Intro-Card had been properly accomplished and all account opening requirements have been complied with. If the Intro-Cards are not signed by the prospects, then the participants who referred these prospects will not earn award points. The Branch Officers shall exercise the necessary diligence controls in allowing or disallowing the opening of the account.

The Branch Operations Officer shall certify that the account opened is eligible under the program.

Every week, the branch will forward the duly-accomplished and verified Intro-Cards to the Program Headquarters. The month-end cut-off date is the 5th day of the following month, e.g., the cut-off date for July 2019 transactions is August 5, 2019. Intro-Cards received after the cut-off date will be included and credited in the succeeding month. Thus, introduction cards for July 2019 transactions received by Program Headquarters after August 5 will not be included in the July Award Points Statement; they will be included in the August Award Points Statement instead.

All Intro-Cards will be processed at the Program Headquarters to produce the Monthly Award Points Statement for all participants. The Statement will summarize all the transactions for the month. It will list

- the monthly ADB Award Points of all solicited accounts within the program period;

- the monthly ADB Award Points of the incremental deposits generated for existing accounts;

- the bonus Award Points for individual and group performance, and

- the redeemed Award Predits for merchandise awards.

The Award Points Statements will be released to the individual participant by mid-month for transactions of the previous month; i.e. November 15 for October transactions. You are given two weeks to report to the Program Committee any discrepancy after your statement has been issued.

The Award Points for the Branch Pool and Unit/Department Pool will be reflected in the succeeding cut-off’s Award Statement.

Redemption of Prizes

Award Points are redeemable for prizes displayed and described on the Rewards Catalogue website and in the Rewards Catalogue that will be emailed to everyone. Participants may exchange their Award Points for the reward of their choice at any time during the program or up to three months after the program.

When a participant has accumulated enough Award Points for a desired reward, he/she may simply fill-up the Redemption Form and send the same to the Program Headquarters at the 5th floor of PVB Head Office or e-mail to corpcomm@veteransbank.com.ph.

Once 1ISA receives a redemption claim they will verify and process the claim. Once cleared, the redeeming employee will receive an electronic voucher (eVoucher) or gift certificate (eGC) via email or text.

The employee can then use the eVoucher or eGC at the merchant of his/her choice to avail of a product or service.

In case a specific model or brand of an appliance or item illustrated in the Rewards Catalogue website or printed catalog is not available at the time of redemption, a replacement model or brand will be awarded. Alternately, the participant may opt to accept a different model or brand of equal value or cancel the order.

GRAND TRAVEL AWARD

At the end of the program, the top performing employee in each category of each league and the top overall team leader will qualify for an all-expense paid deluxe vacation trip to an Asian destination provided the qualifier earned the threshold Award Points (to be announced later). Should nobody qualify in the travel for individual category performer in any of the league, the travel slot will be given to the employee with the next highest regular Award Points bank-wide.For purposes of determining the top team leader, he/she would be the team leader of the team with the highest average regular Award Points. For purposes of determining the top league leader, he/she would be the league leader of the league with the highest average regular Award Points. In case where there are more than one league leader of the top league, the one with the higher individual regular Award Points will win the Grand Travel prize.

This grand vacation award will be based on the total regular Award Points earned at the end of the program. This award is non-transferable and not convertible to cash. Expenses incurred in the processing of passports shall be for the account of the participant. Should an employee win more than one Grand Travel Award slot, he/she may opt to have the travel slot used by a member of his/her immediate family member.

Note: As an extra benefit, time spent on this travel will not be considered as availment of regular vacation leave credits so the successful winners will receive their normal earned vacation time in addition to the time spent on the award trip. This travel is a deluxe trip on a twin share basis. Winners will be discouraged from taking along any chaperon even at their own cost as all activities and arrangements are planned on a group basis and are booked accordingly in advance. The travel awards must be taken on a nominated date or else forfeited and cannot be converted to cash.

RESTRICTIONS/PROHIBITIONS

-

These accounts/deposits will not be eligible for the program:

- Existing accounts closed after June 30, 2011 and subsequently reopened as new accounts during the program;

- Accounts closed in one PVB branch reopened in another PVB branch under the same name or in another name during the program; fund transfers from one account to another; name-switching;

- Accounts with loan-related deposit requirements such margin deposits, or any other transaction-related deposit requirements (including payroll accounts);

- All government deposits;

- Accounts given preferential rates;

- Garnished, frozen and PCGG accounts:

- Accounts of affiliate companies or subsidiaries including the account of the PVAO;

- PVAO Pension Account, SSS pension accounts, Trust (TID) accounts, PVB Provident Fund Account, and DepEd payroll accounts;

- All DOSRI loans

- Common Trust Funds and other similar form of deposit/deposit substitute product will not be eligible for Award Points.

- Transfer of accounts/Award Points from one employee to another is not allowed. Pooling of points by employees will not be allowed except for cases of husband and wife employees, and relatives up to the 1st degree of consanguinity.

MISCELLANEOUS

- All employees shall abide by the official program rules and regulations. Any willful disregard of the program rules and regulations shall disqualify the employee from participating in the program. They will also be subjected to further disciplinary action as may be determined according to the Bank’s Code of Conduct and Code of Discipline.

- Taxes arising from the prizes in this campaign shall be for the account of and responsibility of the employees.

- Internal Audit shall verify and investigate any unusual account openings and all unusual fund movements. Findings will be submitted to the Program Committee who will decide on the sanction, if any. The decision of the Committee will be final.